The Rozgar Scheme, which is initiated by the Chief Minister of Punjab, is an important measure of the provincial government of Punjab in order to promote economic prosperity and to alleviate poverty in the province through employment Growth. The scheme creates a critical opportunity for youth, small businesses, and those who are aspiring entrepreneurs to access capital toward starting a business. The core mission of the scheme is to facilitate access to loans at advantageous interest rates in order to foster financial independence of the educated youth and skilled workers in the province of Punjab, as well as many business owners whom have suffered economic stagnation. Overall, the initiative is an important first step toward establishing a sustainable culture of self-reliance and innovativeness that will foster the ability to transform viable business ideas into profitable business opportunities.

Eligibility and Application: Who Can Benefit?

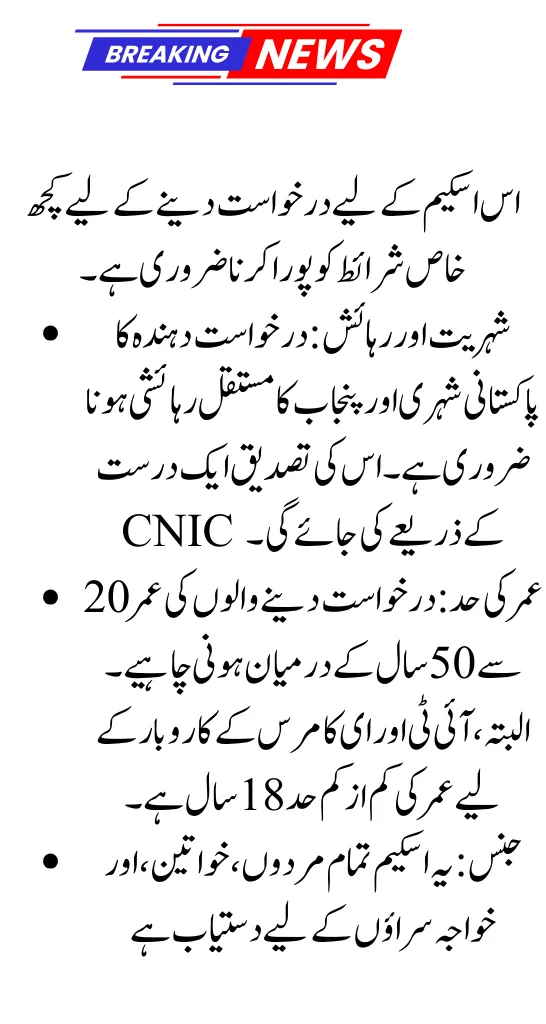

To be eligible for the CM Punjab Rozgar Scheme, applicants must meet specific requirements to ensure the scheme’s goals are achieved. First, applicants must be a citizen of Pakistan and a resident of Punjab, as demonstrated by a valid CNIC. There is an age requirement that applicants are between ages of twenty to fifty years of age. In the case of businesses that are IT or e-commerce-oriented, the lower age requirement can be lowered to age 18. The scheme is open to applicants of all genders – including men, women, and transgender individuals.

Types of Loans and Key Features

The CM Punjab Rozgar Scheme is designed to provide the beneficiaries with an easily accessible and flexible amount of financial assistance tailored to the varying needs of entrepreneurs, in a two-tiered loan structure, consisting of clean loans and secured loans. The loan amount can be allocated from a minimum of PKR 100,000 to a maximum of PKR 10 million.

The maximum amount for clean loans, which is for smaller amounts, is PKR 1 million. These loans do not require collateral, other than a personal guarantee of the borrower, which makes them very accessible to startup businesses and small businesses. The interest rate on clean loans is 4% per annum, at a highly subsidized rate. Secured loans come in amounts anywhere from PKR 1 million to PKR 10 million, and will require some form of collateral based on pledging a mortgage to pledged residential, commercial, industrial, or agricultural property, or a vehicle. The interest rate for secured loans is comparatively low at 5% per annum. The Punjab government covers the remaining markup amount, so the lender can remain at a low rate of interest for the borrower.

Required Documents for a Smooth Application

To ensure a successful application, candidates need to have all the necessary documents prepared in advance. The following is a detailed list of the documents required for submission:

- A valid Computerized National Identity Card (CNIC) of the applicant.

- A recent passport-sized photograph of the applicant.

- The applicant’s domicile certificate, confirming residency in Punjab.

- Educational degrees and/or professional certificates.

- For existing businesses, proof of business registration (if applicable) and a valid NTN (National Tax Number).

- A comprehensive and well-structured business plan outlining the project’s feasibility, financial projections, and operational strategy.

- For secured loans, all relevant property or vehicle documents as collateral.

- In some cases, a clean e-CIB report (Electronic Credit Information Bureau) is required to demonstrate a positive credit history.

Submitting these documents accurately and promptly is crucial for the efficient processing of the application. The online portal provides a user-friendly interface for uploading these files, making the process straightforward and accessible.

Summary of Key Eligibility Criteria

| Particulars | Description |

|---|---|

| Age Limit | 20 to 50 years (18+ for IT/e-commerce) |

| Gender | Male, Female, and Transgender |

| Residence | Citizen of Pakistan, permanent resident of Punjab (verified via CNIC) |

| Education/Skills | University/College Graduates, Diploma/Certificate Holders from TVET, Artisans & Skilled Workers |

| Business Type | New startups and existing businesses |

| Loan Limit | PKR 100,000 to PKR 10,000,000 |

| Interest Rate | 4% for clean loans, 5% for secured loans |

Conclusion

The CM Punjab Rozgar Scheme is a courageous and purposeful initiative by the provincial government in an effort to empower its youth and bolster the economy. By providing accessible and subsidized financed credit to individuals to begin or grow a business, the program has the intended consequences of creating jobs and alleviating poverty. Ultimately, it represents a serious commitment to an enterprising ecosystem reflecting the government’s desire to foster activity in Punjab. The online application process is simple, and the terms low-interest and flexible, providing life-changing opportunities to numerous aspiring entrepreneurs. The program is more than just financing. The goal is to allow people to become self-sufficient and participate in improving prosperity for the people of Punjab. Success of this initiative will not only be measured in loans, but also in which dreams are achieved, and which economic resilience is built in the province.